Malta’s legal framework provides for a range of securitisation transactions under a secure regulatory framework and offers various legal and international tax benefits - making it the jurisdiction of choice for the setting up of tax neutral securitisation vehicles.

The Securitisation Act provides that no proceedings taken against the Originator under any law, including any dissolution and winding-up proceedings will have any effect on the SPV, any securitisation assets acquired or risks assumed by the SPV, as well as any cashflow or other asset of the SPV, and any payments due by the underlying debtors in connection with the securitised assets.

Malta’s legal framework provides for a range of securitisation transactions under a secure regulatory framework and offers various legal and international tax benefits - making it the jurisdiction of choice for the setting up of tax neutral securitisation vehicles.

The Securitisation Act provides that no proceedings taken against the Originator under any law, including any dissolution and winding-up proceedings will have any effect on the SPV, any securitisation assets acquired or risks assumed by the SPV, as well as any cashflow or other asset of the SPV, and any payments due by the underlying debtors in connection with the securitised assets.

Country Highlights

| GDP GROWTH: 6.3% in 2015 |

EUROPEAN UNION: Member of the EU & Eurozone |

| TIMEZONE: Central European Time Zone (UTC +01:00) |

REGULATOR: Malta Financial Sercives Authority |

| BANKING SYSTEM: 10th soundest system in the world (WEF) |

STAMP DUTY:Exemption applicable to securtisation vehicle with 90% business interests outside Malta |

| FINANCIAL SECTOR: 25% annual expansion |

FINANCIAL SERVICES FRAMEWORK: EU and OECD approved |

Legal Basis

Securitisation transactions are regulated under the Securitisation Act, Chapter 484 of the Laws of Malta, which provides for a versatile regime with various options with respect to the form of the securitisation vehicles, as well as the kind of assets that can be securitized.

The Securitisation Act provides that no proceedings taken against the Originator under any law, including any dissolution and winding-up proceedings will have any effect on the SPV, any securitisation assets acquired or risks assumed by the SPV, as well as any cashflow or other asset of the SPV, and any payments due by the underlying debtors in connection with the securitised assets.

Benefits

- Fast process: 2-3 weeks;

- Tax Neutral;

- No local presence required;

- Bankruptcy Remoteness;

- VAT Neutral;

Eligibility

- Private / Public Offering determination;

- Legal Form;

- Securitised Assets;

- Offering Documents;

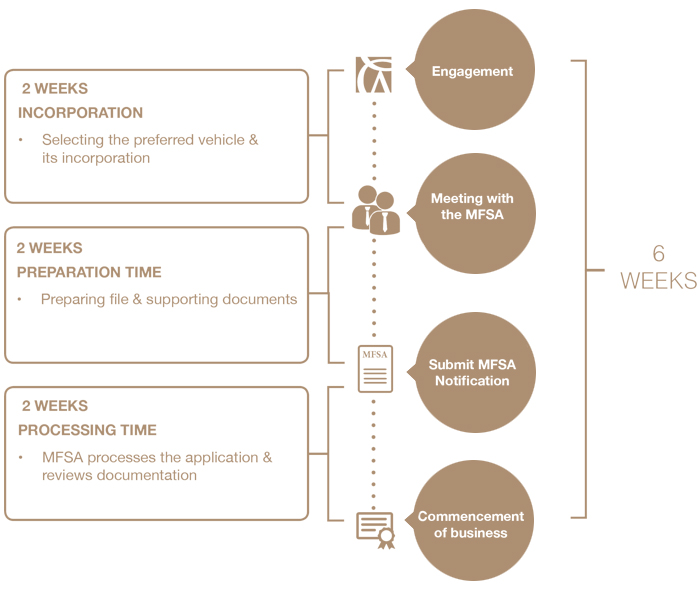

Process & Timeline

Why Work With Us