In the light of increased scrutiny of the investment migration industry, Chetcuti Cauchi has carried out a detailed assessment of due diligence procedures adhered to across the industry, specifically those pertaining to Citizenship by Investment Programmes (CIPs).

Chetcuti Cauchi’s CIP Due Diligence Index (CIP DD Index) assesses the current due diligence procedures carried out by citizenship units and agencies. Complementing this, we propose an industry-wide due diligence framework based on the in-depth study and consequent results of the Index.

Introducing the CIP Due Diligence Index

Beyond ranking due diligence of different Citizenship by Investment Programmes, the CIP DD Index also addresses the primary concerns of relevant international institutions regarding perceived external repercussions of the investment migration industry. These have mainly revolved around security concerns, risks of money laundering, and the potential for circumventing EU laws and evading tax. In an effort to dissolve these misguided perceptions, the Index puts forward an overview of the due diligence practice followed across the Citizenship by Investment industry, while also acknowledging what more could be done to solidify the industry’s security and international standing.

CIP Due Diligence Index: Methodology

The CIP DD Index is built on Chetcuti Cauchi’s 5 Pillars of CIP Due Diligence: Identification, Financial Due Diligence, Clearances, Enhanced Due Diligence, and Reputation. 38 different criteria are dispersed across these 5 Pillars. The chosen criteria not only reflect the established due diligence and compliance standards adhered across the migration industries, but also take into consideration the recommended procedures expressed by concerned institutions.

A programme is granted points depending on how many criteria it satisfies in each pillar. The data is then normalised to produce the scores for each of the five pillars. In doing so, the pillars are not allocated weights based on the varying number of corresponding criteria, thus eliminating any bias towards a specific pillar. The final score is produced based on the average collective performance in the 5 Pillars. Each Citizenship by Investment Programme was then ranked according to the overall scores, to produce the CIP DD Index.

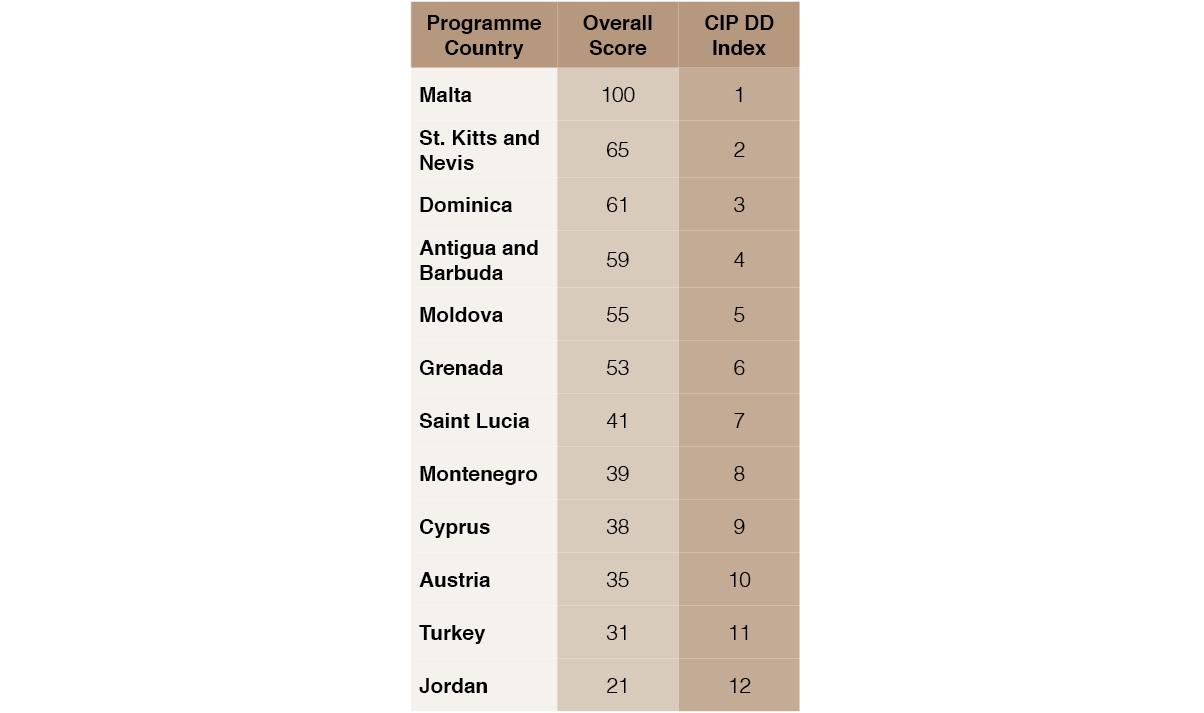

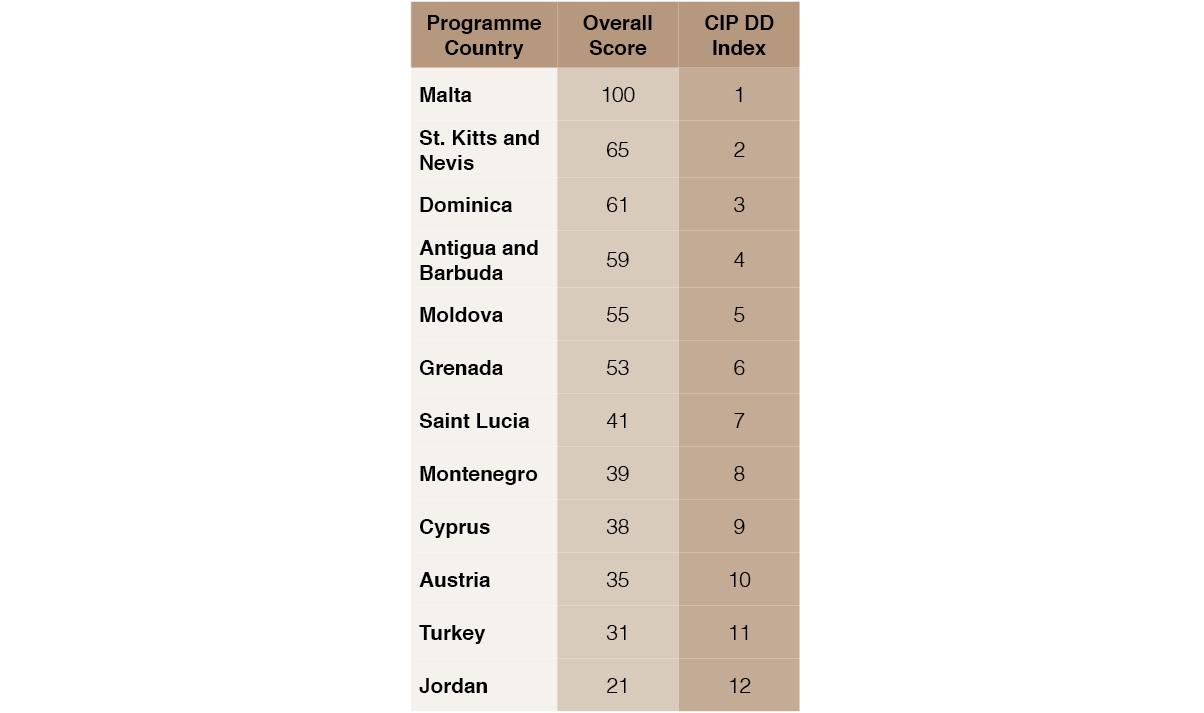

Results of the CIP Due Diligence Index

The Malta Individual Investor Programme quickly stands out as having the most extensive due diligence checks in place, ranking in first place. The Malta Individual Investor Programme Agency (MIIPA)’s comprehensive four-tier process and internal risk matrix established an impeccable standard for due diligence procedures.

St. Kitts and Nevis, Antigua and Barbuda, Dominica, Grenada, and Moldova also stand out as having established their own exhaustive procedures. Whilst not all CIPs abide by the same procedure, the overall level of due diligence followed across the board is still indisputably robust.

Identification is, for the most part, standardised across CIUs, with most CIUs more or less asking for the same list of personal or legal documents. The same can be said for the majority of the established programmes with regards to Financial Due Diligence. Clearances vary across the industry, nevertheless most programmes require the go-ahead from international police authorities, follow standard KYC due diligence, refer to sanctions lists, and take in consideration visa, residency or citizenship refusals. The Enhanced Due Diligence stage is where we start seeing the most variation amongst CIUs. Lastly, the checks followed for the Reputation remain primarily unique to Malta. These namely comprise a detailed impact evaluation of the main applicant’s activities including social activities, affiliations, and memberships.

Recommendations for an International Standard of CIP Due Diligence

Our assessment conducted in formulating the CIP Due Diligence Index makes it clear that the most critical of due diligence procedures are adhered by all CIUs. Nonetheless, the Index demonstrates that some CIPs could go the extra mile in executing their due diligence. In light of this, the CIP Due Diligence Index recommends the setting up of a single global CIP due diligence standard that applies the 5 Pillars of CIP Due Diligence, namely: Primary Documentation, Source of Wealth and Funds, Clearances, Enhanced Due Diligence and Reputation.

With respect to the first four pillars, the Index proposes enhanced measures and increased heightened to detail. As to the fifth Pillar, namely the Reputational due diligence assessment, this should also be incorporated for a more holistic approach.

To complement the establishment of this converged standard, the Industry should also take care to implement other measures. As elaborated in the Index, these include amplified transparency, cooperation and governance, the establishment of autonomous citizenship agencies within each programme country, regulation and supervision of industry professionals, and lastly, the promotion of inter-governmental cooperation.

Learn more by downloading the report!

In the light of increased scrutiny of the investment migration industry, Chetcuti Cauchi has carried out a detailed assessment of due diligence procedures adhered to across the industry, specifically those pertaining to Citizenship by Investment Programmes (CIPs).

Chetcuti Cauchi’s CIP Due Diligence Index (CIP DD Index) assesses the current due diligence procedures carried out by citizenship units and agencies. Complementing this, we propose an industry-wide due diligence framework based on the in-depth study and consequent results of the Index.

Introducing the CIP Due Diligence Index

Beyond ranking due diligence of different Citizenship by Investment Programmes, the CIP DD Index also addresses the primary concerns of relevant international institutions regarding perceived external repercussions of the investment migration industry. These have mainly revolved around security concerns, risks of money laundering, and the potential for circumventing EU laws and evading tax. In an effort to dissolve these misguided perceptions, the Index puts forward an overview of the due diligence practice followed across the Citizenship by Investment industry, while also acknowledging what more could be done to solidify the industry’s security and international standing.

CIP Due Diligence Index: Methodology

The CIP DD Index is built on Chetcuti Cauchi’s 5 Pillars of CIP Due Diligence: Identification, Financial Due Diligence, Clearances, Enhanced Due Diligence, and Reputation. 38 different criteria are dispersed across these 5 Pillars. The chosen criteria not only reflect the established due diligence and compliance standards adhered across the migration industries, but also take into consideration the recommended procedures expressed by concerned institutions.

A programme is granted points depending on how many criteria it satisfies in each pillar. The data is then normalised to produce the scores for each of the five pillars. In doing so, the pillars are not allocated weights based on the varying number of corresponding criteria, thus eliminating any bias towards a specific pillar. The final score is produced based on the average collective performance in the 5 Pillars. Each Citizenship by Investment Programme was then ranked according to the overall scores, to produce the CIP DD Index.

Results of the CIP Due Diligence Index

The Malta Individual Investor Programme quickly stands out as having the most extensive due diligence checks in place, ranking in first place. The Malta Individual Investor Programme Agency (MIIPA)’s comprehensive four-tier process and internal risk matrix established an impeccable standard for due diligence procedures.

St. Kitts and Nevis, Antigua and Barbuda, Dominica, Grenada, and Moldova also stand out as having established their own exhaustive procedures. Whilst not all CIPs abide by the same procedure, the overall level of due diligence followed across the board is still indisputably robust.

Identification is, for the most part, standardised across CIUs, with most CIUs more or less asking for the same list of personal or legal documents. The same can be said for the majority of the established programmes with regards to Financial Due Diligence. Clearances vary across the industry, nevertheless most programmes require the go-ahead from international police authorities, follow standard KYC due diligence, refer to sanctions lists, and take in consideration visa, residency or citizenship refusals. The Enhanced Due Diligence stage is where we start seeing the most variation amongst CIUs. Lastly, the checks followed for the Reputation remain primarily unique to Malta. These namely comprise a detailed impact evaluation of the main applicant’s activities including social activities, affiliations, and memberships.

Recommendations for an International Standard of CIP Due Diligence

Our assessment conducted in formulating the CIP Due Diligence Index makes it clear that the most critical of due diligence procedures are adhered by all CIUs. Nonetheless, the Index demonstrates that some CIPs could go the extra mile in executing their due diligence. In light of this, the CIP Due Diligence Index recommends the setting up of a single global CIP due diligence standard that applies the 5 Pillars of CIP Due Diligence, namely: Primary Documentation, Source of Wealth and Funds, Clearances, Enhanced Due Diligence and Reputation.

With respect to the first four pillars, the Index proposes enhanced measures and increased heightened to detail. As to the fifth Pillar, namely the Reputational due diligence assessment, this should also be incorporated for a more holistic approach.

To complement the establishment of this converged standard, the Industry should also take care to implement other measures. As elaborated in the Index, these include amplified transparency, cooperation and governance, the establishment of autonomous citizenship agencies within each programme country, regulation and supervision of industry professionals, and lastly, the promotion of inter-governmental cooperation.

Learn more by downloading the report!