Over the past decade, Malta has become a prime fintech hub attracting electronic money institutions and payment service providers, and devel¬oped into the world’s largest iGaming hub. Consequently, Malta invested heavily in its IT infrastructure and attracted a large proportion of senior IT talent to the island. In its pursuit of developing into a European financial services centre of choice, Malta had already gained experience in tech-based, high-risk industries, which positioned the island perfectly to capitalise on the rise of DLT technology.

In order to benefit from the vast potential of this industry, the Government of Malta designed a legal framework for innovative technology that is built upon three pillars: consumer protection, market integrity and financial sta¬bility. Market participants may rely on the reputability of the Malta’s legal framework in this sector that guarantees investor protection, whilst at the same time provides businesses and entrepreneurs with a stable yet pro-business environment within which they can raise funds through an ICO/IEO or provide VFA Services in or from within Malta.

Over the past decade, Malta has become a prime fintech hub attracting electronic money institutions and payment service providers, and devel¬oped into the world’s largest iGaming hub. Consequently, Malta invested heavily in its IT infrastructure and attracted a large proportion of senior IT talent to the island. In its pursuit of developing into a European financial services centre of choice, Malta had already gained experience in tech-based, high-risk industries, which positioned the island perfectly to capitalise on the rise of DLT technology.

In order to benefit from the vast potential of this industry, the Government of Malta designed a legal framework for innovative technology that is built upon three pillars: consumer protection, market integrity and financial sta¬bility. Market participants may rely on the reputability of the Malta’s legal framework in this sector that guarantees investor protection, whilst at the same time provides businesses and entrepreneurs with a stable yet pro-business environment within which they can raise funds through an ICO/IEO or provide VFA Services in or from within Malta.

Country Highlights

GDP GROWTH: 6.6% IN 2018 |

REGULATOR: Malta Financial Services Authority |

TIMEZONE: Central European Time Zone

(UTC+01:00) | FINANCIAL SERVICES FRAMEWORK: EU and OECD Approved |

| FINANCIAL SECTOR: 25% Annual Expansion | FINANCIAL TECHNOLOGY LAW: First in the World |

Legal Basis

The legal framework specifically designed by the Government of Malta to regulate Virtual Financial Assets (VFAs) and Virtual Financial Assets related services (‘VFA Services’) comprises a series of three laws:

- the Malta Digital Innovation Authority Act (MDIA Act) establishing the Malta Digital Innovation Authority (MDIA);

- the Innovative Technology Arrangements and Services Act (ITAS Act) providing for registration of technology service providers and the certification of technology arrangements; and

- the Virtual Financial Assets Act (VFAA) mainly regulating initial VFA offerings, VFA service providers and VFA agents.

Depending on the structure of the DLT asset, a Maltese entity seeking to launch an IEO from Malta will generally be treated as an ‘Issuer’ in terms of the Virtual Financial Assets Act.

Benefits

- Reputable Jurisdiction: Clear Regulatory Requirements

- Rules and Documentation in English

- Consumer Protection, Market Integrity and Financial Stability

- Attractive Corporate Tax Regime

- Reduced costs: KYC & administrative procedures carried out by the Exchange

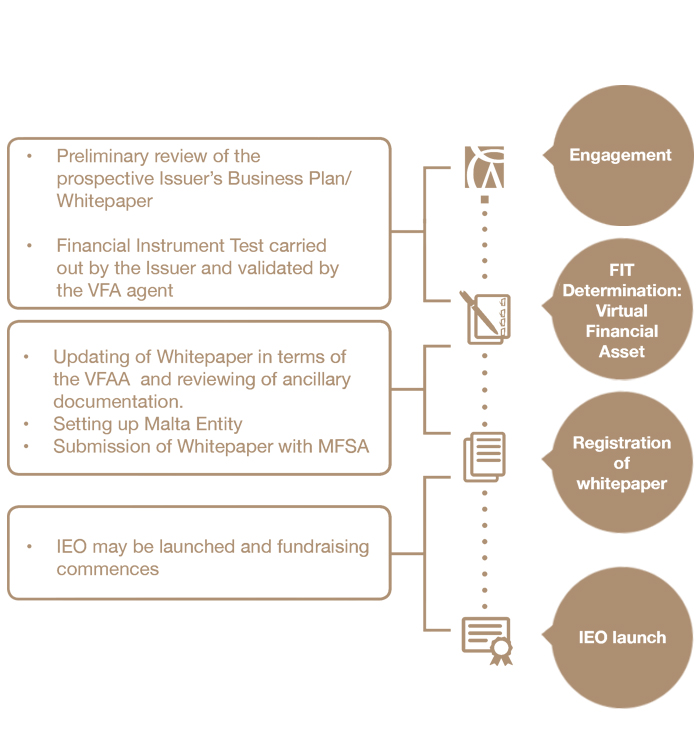

Eligibility

- Appoint a VFA Agent

- Fit & Proper Test by VFA Agent

- Undertake the Financial Instrument Test

- Local Malta Entity

- Register Whitepaper with MFSA

Process & Timeline

Why Work With Us