Foundations have been present in Maltese laws and practice for many years. Nevertheless, it is the recent revamping of the foundation laws that allowed Malta to take up the position of one of the leading foundation jurisdictions worldwide.

A Malta foundation has a separate legal personality, which makes it a powerful tool for asset protection. Although foundations may not engage in any commercial activity, they are allowed to hold investments or property (e.g. real estate, trademarks, yachts), as well as receive income derived therefrom (e.g. in the form of dividends, royalties or interest). Foundations may also be used, inter alia, as a collective investment or securitisation vehicles.

Consequently, Malta foundations are often regarded as attractive alternatives to trusts, especially if they are used in structures involving jurisdictions that do not recognise trust laws. This is more so because foundations may also elect to be treated under applicable tax laws as trusts. This option combines the advantages of a separate legal personality and the possibility of applying Malta trust taxation rules.

Foundations have been present in Maltese laws and practice for many years. Nevertheless, it is the recent revamping of the foundation laws that allowed Malta to take up the position of one of the leading foundation jurisdictions worldwide.

A Malta foundation has a separate legal personality, which makes it a powerful tool for asset protection. Although foundations may not engage in any commercial activity, they are allowed to hold investments or property (e.g. real estate, trademarks, yachts), as well as receive income derived therefrom (e.g. in the form of dividends, royalties or interest). Foundations may also be used, inter alia, as a collective investment or securitisation vehicles.

Consequently, Malta foundations are often regarded as attractive alternatives to trusts, especially if they are used in structures involving jurisdictions that do not recognise trust laws. This is more so because foundations may also elect to be treated under applicable tax laws as trusts. This option combines the advantages of a separate legal personality and the possibility of applying Malta trust taxation rules.

Country Highlights

| EU:Member of the EU & Eurozone |

TAX SYSTEM: Flexible |

TIMEZONE: Central European Time Zone

(UTC+01:00) |

NO WITHHOLDING TAX: On outbound dividends |

| CURRENCY: Euro € |

SECTOR REGULATION: Authorized by Malta Financial

Services Authority |

| WORKFORCE: Well qualified and multilingual |

DOUBLE TAX TREATIES: Broad network of approx. 70 signed

DTTS |

Legal Basis

The main rules governing taxation of a Malta private foundation are provided in the Malta Income Tax Act and in the Foundations (Income Tax) Regulations.

The general rule is that a Malta private foundation is taxed in the same manner as a company that is ordinarily resident and domiciled in Malta. Nevertheless, the administrators of a foundation may irrevocably elect for the foundation to be taxed under the provisions applicable to trusts.

Benefits

- Separate Legal Personality

- Asset Protection

- Flexible Tax Treatment

- Reputable EU Jurisdiction

Eligibility

A trust would be‘tax transparent’ where the following conditions are met cumulatively:

(a) all the income attributable to a foundation consists of

(i) income arising outside Malta, and/or

(ii) interest, discount, premium or royalties or gains or profits arising from the disposal of units in a collective investment scheme or any units and such like instruments relating to linked long term business of insurance, or shares in a company which is not a property company, and/or

(iii) dividends distributed by one or more companies registered in Malta, out of the foreign income account and (b) all the beneficiaries of the foundation are persons who are not resident in Malta.

A foundation would still be regarded as tax transparent, where any of its beneficiaries are tax resident in Malta, provided that all the income attributable to a foundation consists of income listed in points (i) and/or (ii) above, and provided that all the beneficiaries of the foundation are not domiciled in Malta.

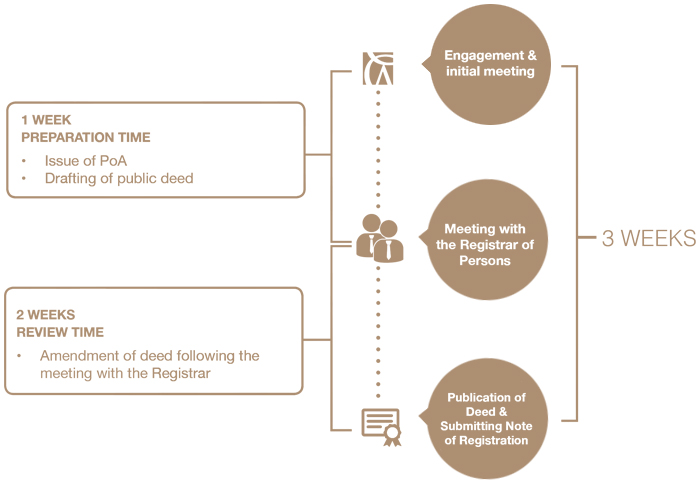

Process & Timeline

Why Work With Us