Malta enjoys a stable political climate and a bi-partisan political scene that is largely convergent on issues of national and economic importance. The country is considered to be one of the best performing Eurozone economies, with a steady economic growth and low unemployment rate.

Malta Trading Companies are excellently poised to provide international entrepreneurs with the ideal platform for the establishment of international trading activities. A Malta Trading Company may be utilised for numerous trading activities such as but not limited to, information technology & telecommunications, e-commerce, market research, i-gaming, financial services, pharma, shipping and aviation, as well as, oil and gas.

Malta enjoys a stable political climate and a bi-partisan political scene that is largely convergent on issues of national and economic importance. The country is considered to be one of the best performing Eurozone economies, with a steady economic growth and low unemployment rate.

Malta Trading Companies are excellently poised to provide international entrepreneurs with the ideal platform for the establishment of international trading activities. A Malta Trading Company may be utilised for numerous trading activities such as but not limited to, information technology & telecommunications, e-commerce, market research, i-gaming, financial services, pharma, shipping and aviation, as well as, oil and gas.

Country Highlights

| APPLICABLE LAW: Malta Companies Act | TAX SYSTEM: EU Approved |

| CAPITAL DUTY: None | CURRENCY: Euro € |

| DOUBLE TAX TREATY: Extensive double tax treaty network | CAPITAL GAINS EXEMPTION: On certain transfer of shares & immovable property |

| TIMEZONE: Central European Time Zone(UTC+01:00) | NO WITHOLDING TAX: On outbound dividends, interest or royalties |

Legal Basis

Malta Companies Act, which is the principal piece of Malta Trading Companies are incorporated in terms of the Maltese Companies Act, which is the principal piece of corporate law in Malta. The Act is predominantly based on common law principles, and is also in line with EU Directives.

Malta Trading Companies are onshore entities setup as partnerships or limited liability companies - the latter being the most popular corporate entities, due to their flexibility and tax efficiency.

Benefits

- Gives applecant an ability to re-domicile;

- Effective tax rate which is 5%;

- Easy same day incorporation;

- Relatively low costs on establishment and operating;

- Notary and court process is not required.

Eligibility

- Minimum initial share capital should be paid up is €1,250;

- Appointment of Malta local director and company secretary;

- Minimum number of shareholders is 1;

- Applicant should provide all company formation documents;

- Appointment of an auditor.

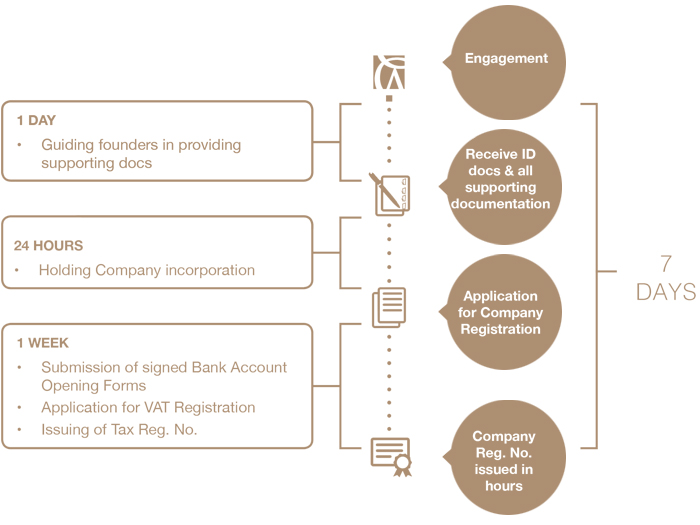

Process & Timeline

Why Work With Us