Malta has established itself as a prime fintech hub for over more than a decade by attracting to the island a large number of electronic money institutions and payment service providers, as well as having developed into the world’s largest iGaming hub.

This led Malta to invest heavily in its IT infrastructure and has drawn a large proportion of senior IT talent to the island. This experience in a tech based, high-risk industry positioned Malta perfectly to capitalise on the rise of distributed ledger technology (DLT).

Malta’s progressive attitude towards DLTs (including blockchain) and cryptocurrencies has already attracted some of the world’s largest crypto exchanges who have either relocated to or commenced additional operations in Malta.

Malta has sought to create a regulated framework for innovative technology that is built upon three pillars: consumer protection, market integrity and financial stability. This comprehensive legal framework is a world first and was eagerly anticipated by fintech experts, operators and investors.

Malta has established itself as a prime fintech hub for over more than a decade by attracting to the island a large number of electronic money institutions and payment service providers, as well as having developed into the world’s largest iGaming hub.

This led Malta to invest heavily in its IT infrastructure and has drawn a large proportion of senior IT talent to the island. This experience in a tech based, high-risk industry positioned Malta perfectly to capitalise on the rise of distributed ledger technology (DLT).

Malta’s progressive attitude towards DLTs (including blockchain) and cryptocurrencies has already attracted some of the world’s largest crypto exchanges who have either relocated to or commenced additional operations in Malta.

Malta has sought to create a regulated framework for innovative technology that is built upon three pillars: consumer protection, market integrity and financial stability. This comprehensive legal framework is a world first and was eagerly anticipated by fintech experts, operators and investors.

Country Highlights

| GDP GROWTH: 6.6% in 2017 |

REGULATORS: Malta Financial Services Authority, Malta Digital Innovation Authority |

| TIMEZONE: Central European Time Zone (UTC+01:00) |

FINANCIAL SERVICES FRAMEWORK: EU and OECD approved |

| FINANCIAL SECTOR: 25% Annual Growth |

FINANCIAL TECHNOLOGY LAW: First in World |

Legal Basis

The legal framework specifically designed by the Government of Malta to regulate virtual financial assets (VFAs) and virtual financial assets related services (‘VFA Services’) comprises a series of three laws:

- the Malta Digital Innovation Authority Act (MDIA Act) establishing the Malta Digital Innovation Authority (MDIA);

- the Innovative Technology Arrangements and Services Act (ITAS Act) providing for registration of technology service providers and the certification of technology arrangements; and

- the Virtual Financial Assets Act (VFAA) mainly regulating initial coin offerings (ICOs), VFA service providers and VFA agents.

The Malta Financial Services Authority (MFSA) is the lead regulator for VFAs and VFA service providers. However, certain innovative technology arrangements, including DLTs and smart contracts may be referred to the Malta Digital Innovation Authority for further certification.

A utility token offering is outside the VFAA’s scope. The prior determination of a DLT asset as a utility token, however, is to be undertaken in line with the VFAA and the MFSA’s guidance notes.

Benefits

- Utility Token Offerings: No Regulatory Requirements

- Rules and Documentation in English

- Consumer Protection, Market Integrity and Financial Stability

- Reputable Jurisdiction

- Attractive Corporate Tax Regime

Eligibility

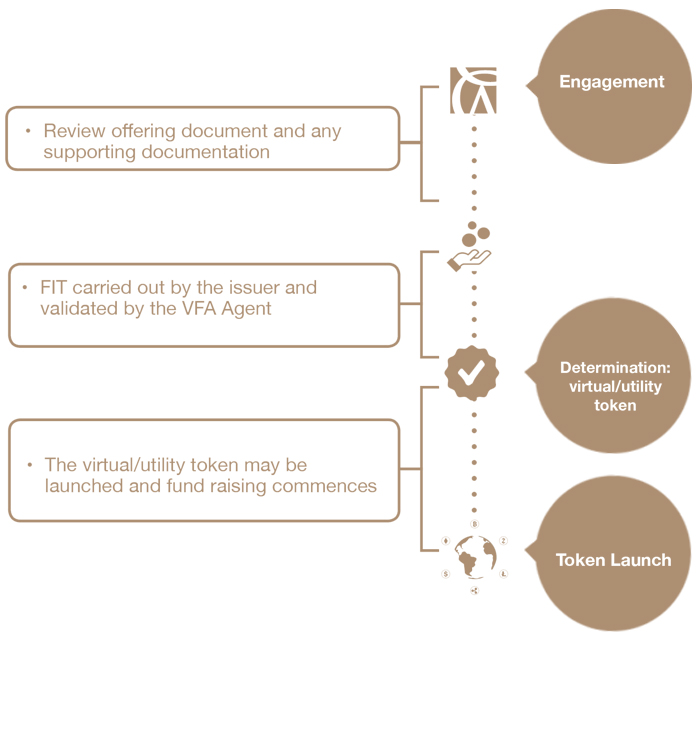

- Undertake Fit & Proper Test

- Appointment of VFA Agent

- Token: Limited Utility and Non-Exchangeability

- Undertake Financial Instrument Test

Process & Timeline

Why Work With Us