Where the participation exemption as outlined below does not apply, or where the company does not opt for the exemption, a Malta holding company would be subject to tax on income less deductible expenses at the corporate income tax rate of 35%. Upon receipt of a dividend, the shareholders would be eligible to claim a refund of all or part of the tax paid, depending on the type and source of income received. The shareholder of the Malta company would be eligible to receive refunds as follows:

- 100% of the Malta tax paid where income or gains are derived from an investment which qualifies as a Participating Holding (PH) and in the case of dividend income, where such PH falls within the safe harbours or satisfies the anti-abuse provisions as detailed below.

- 5/7ths of the Malta tax paid, where the income received by the company is passive interest or royalties or income from a PH which does not fall within the safe harbours or satisfy the anti-abuse provisions

- 2/3rds of the tax payable in Malta, where income has benefited from double taxation relief.

- 6/7ths of the Malta tax in all other cases.

Where the participation exemption as outlined below does not apply, or where the company does not opt for the exemption, a Malta holding company would be subject to tax on income less deductible expenses at the corporate income tax rate of 35%. Upon receipt of a dividend, the shareholders would be eligible to claim a refund of all or part of the tax paid, depending on the type and source of income received. The shareholder of the Malta company would be eligible to receive refunds as follows:

- 100% of the Malta tax paid where income or gains are derived from an investment which qualifies as a Participating Holding (PH) and in the case of dividend income, where such PH falls within the safe harbours or satisfies the anti-abuse provisions as detailed below.

- 5/7ths of the Malta tax paid, where the income received by the company is passive interest or royalties or income from a PH which does not fall within the safe harbours or satisfy the anti-abuse provisions

- 2/3rds of the tax payable in Malta, where income has benefited from double taxation relief.

- 6/7ths of the Malta tax in all other cases.

Country Highlights

| TAX SYSTEM EU: EU Approved |

EU: Member of the EU & Eurozone |

| CAPITAL DUTY: None |

WORKFORCE: Well qualified, multi lingual workforce |

| CAPITAL GAINS EXEMPTION: On certain transfer of shares& immovable property |

NO WITHHOLDING TAX: On outbound dividend, interest or royalties

|

| DOUBLE TAX TREATY: Extensive double tax treaty network |

|

Legal Basis

The principles for the taxation of Malta holding companies are derived from the Malta Income Tax Act and the Malta Income Tax Management Act.

The Income Tax Act regulates the tax treatment of income, such as by outlining the manner by which profits or dividends are to be taxed. It also provides for the tax treatment of capital gains, such as gains deriving from the transfer of immovable property situated in Malta. The Malta tax refund system, along with other formalities are

then regulated by the Income Tax Management Act.

Benefits

- Our reputation is that of an EU jurisdiction;

- Participation exemption regime;

- No restrictions to holding activities, may also carry out trading activities;

- No withholding tax on outbound dividends;

- Gains on disposal of shares by non-residents are exempt from tax in Malta;

Eligibility

- Resident or incorporated in the EU;

- Subject to any foreign tax at a rate of at least 15%;

- Less than 50% of its income is derived from passive interest or royalties;

- The equity shares held in the non-resident company do not represent a portfolio investment;

- Non-resident company or its passive interest or royalties have been subject to tax at a rate which is not less than 5%;

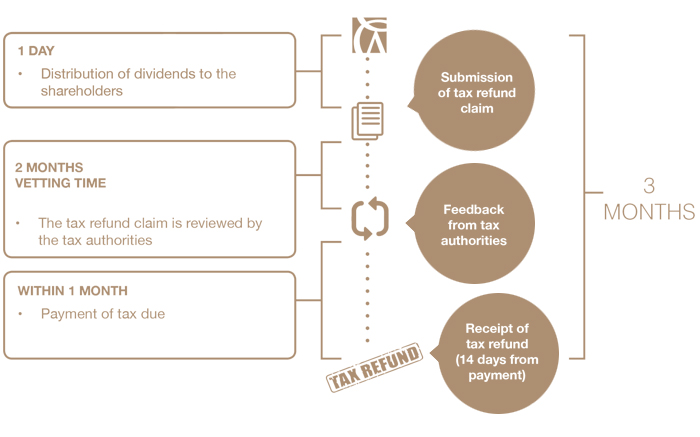

Process & Timeline

Why Work With Us